Uncategorized

How to Get the Best Mortgage Series – Week 5 Follow this series to learn how to get the best mortgage for your specific financial situation and goals. You’ll see what steps you need to take throughout this process to make it productive and successful. This week you’ll learn why the interest rate you see advertised […]

continue reading...

How to Get the Best Mortgage Series – Week 1 Follow this series to learn how to get the best mortgage for your specific financial situation and goals. You’ll see what steps you need to take throughout this process to make it productive and successful! This week’s article is all about what to say when you first contact a […]

continue reading...

You love your neighborhood and everything about where you live, but you wish you could make some changes to your home. You’re not alone with this thinking. But many homeowners don’t move forward since they believe that financing and lack of cash is a roadblock for them when it comes to renovating their current home. […]

continue reading...

In this 3-part series, Greening Your Home, you’ll learn ways to make your home more energy-efficient while also saving you money in the long run. Caring about the environment and being “green” can be easier than you think as a homeowner. You can start today! Here’s the final article and it’s all about how to plant […]

continue reading...

Having a high credit score is important all the time, whether you are buying a home anytime soon or not. Your FICO score and credit report are so vital to getting any type of loan, and this series will give you the financial strategies you need to get your credit score as high as possible. If […]

continue reading...

Bonus – Love Buying a Home series I’m not done just yet! Here’s a bonus article for my recent 13-part series, Love Buying a Home. This step-by-step series took you through the entire home-buying process — from finding a buyer’s agent to settlement day. Now you’ll learn a few tips on how take care of your […]

continue reading...

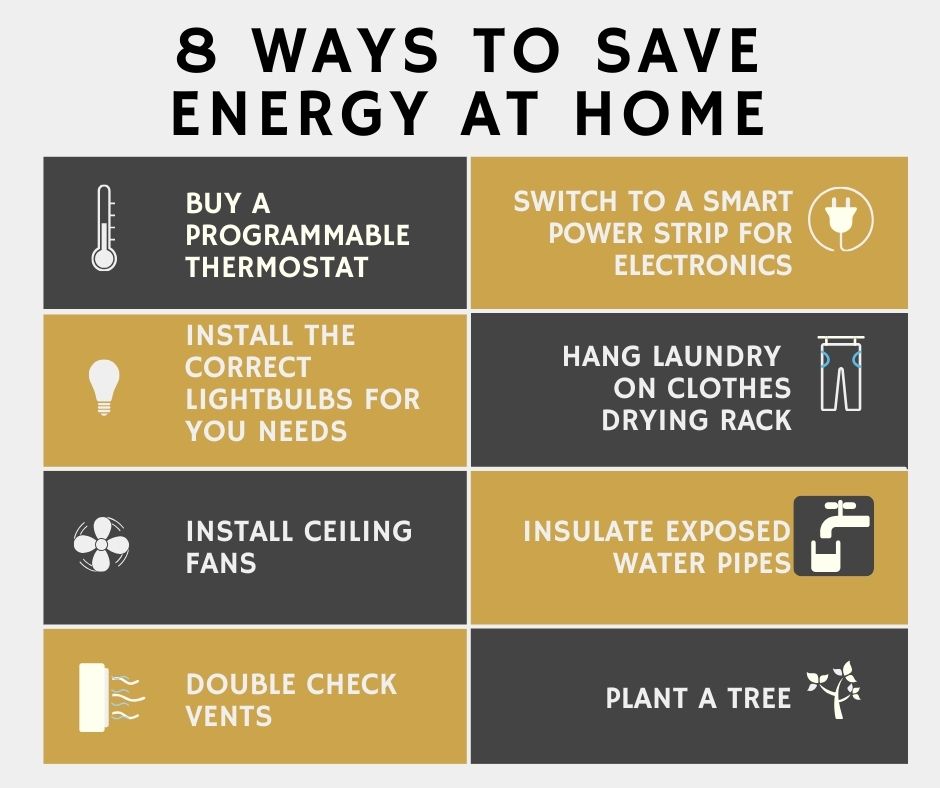

In this 3-part series, Greening Your Home, you’ll learn ways to make your home more energy-efficient while also saving you money in the long run. This second article lists some simple ways you can save energy in your home. Caring about the environment and being “green” can be easier than you think as a homeowner. You […]

continue reading...

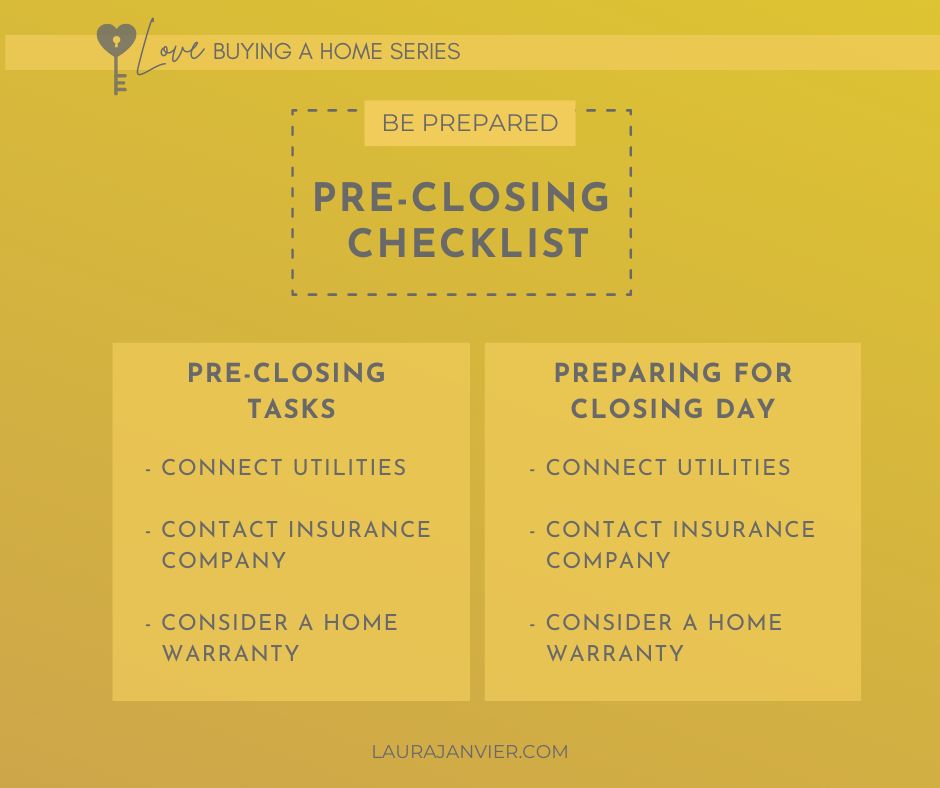

Love Buying a Home series – Week 13 This step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. This series wraps up today but stay tuned […]

continue reading...

Love Buying a Home series – Week 12 This step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for the next […]

continue reading...

Love Buying a Home – Week 11 This step-by-step series will take you through the entire home-buying process — from finding a buyer’s agent to settlement day, and all the details in between. Every first-time buyer will find this information-packed series easy to follow and understand. Make sure to tune in for the next few […]

continue reading...

Hi, I’m Laura. I help first time homebuyers in Atlanta make their purchase more affordable. If you have a desire to be a homeowner, but not sure if its possible, let's find out together!

You might be thinking that interest rates are too high, you're paying off your student loans, or you don't have a big enough down payment. You may even be thinking because of inflation, you can't afford a home right now. But the truth is, if you want to stop renting and become a homeowner in Atlanta, it might be possible.

Here's the best news, if you've graduated from an HBCU, there are programs you can get to help with your down payment so you can stop renting sooner than you might think.

I'm on a mission to help people like me, who historically by law were not allowed to and/or could not afford to be homeowners, to be able to afford a home.

The first step is for us to figure out what is possible and I invite you to meet with me so we can talk through your financial situation, goals, and see what we can do for you.

Let's do this!

It's time!

get my free weekly series about how to make your first home in atlanta more affordable

Enter your email address & name and I'll share what it takes to be a first time homebuyer in Atlanta!

Schedule a free consultation now and let's find out what's possible.